All You Need to Know About Atal Pension Yojana Benefits

Planning for retirement can feel overwhelming, especially when you’re young and retirement seems like a distant dream. But what if there was a simple, government-backed scheme that could guarantee you a steady pension after age 60? Enter the Atal Pension Yojana (APY), a revolutionary pension scheme launched by the Government of India in 2015. This comprehensive guide will walk you through everything you need to know about atal pension yojana benefit and how it can transform your golden years.

What Makes Atal Pension Yojana Special?

The Atal Pension Yojana stands out as one of India’s most accessible pension schemes. Named after former Prime Minister Atal Bihari Vajpayee, this scheme targets the unorganized sector workers who often lack proper retirement planning options. The beauty of APY lies in its simplicity and guaranteed returns.

Unlike market-linked investments that can go up or down, the scheme of atal pension yojana offers fixed pension amounts based on your contributions. Whether the stock market crashes or soars, your pension remains secure. This government guarantee makes it an attractive option for risk-averse individuals who want certainty in their retirement planning.

The scheme operates on a simple principle: contribute regularly during your working years, and receive a fixed pension for life after turning 60. It’s like planting a money tree that will bear fruit throughout your retirement years.

Who Can Join This Amazing Scheme?

The atal pension yojana eligibility criteria are designed to be inclusive and straightforward. Here’s who can apply:

Age Requirements

- Minimum age: 18 years

- Maximum age: 40 years

- Must join before turning 40 to get full benefits

Basic Requirements

- Indian citizen

- Valid Aadhaar card

- Active bank account

- Mobile number linked to Aadhaar

Income Criteria

The scheme primarily targets individuals who:

- Don’t pay income tax

- Work in the unorganized sector

- Don’t have access to formal pension schemes

- Earn modest incomes

One of the best features is that even if you become a taxpayer later, you can continue with the scheme. However, the government co-contribution (which we’ll discuss later) will stop.

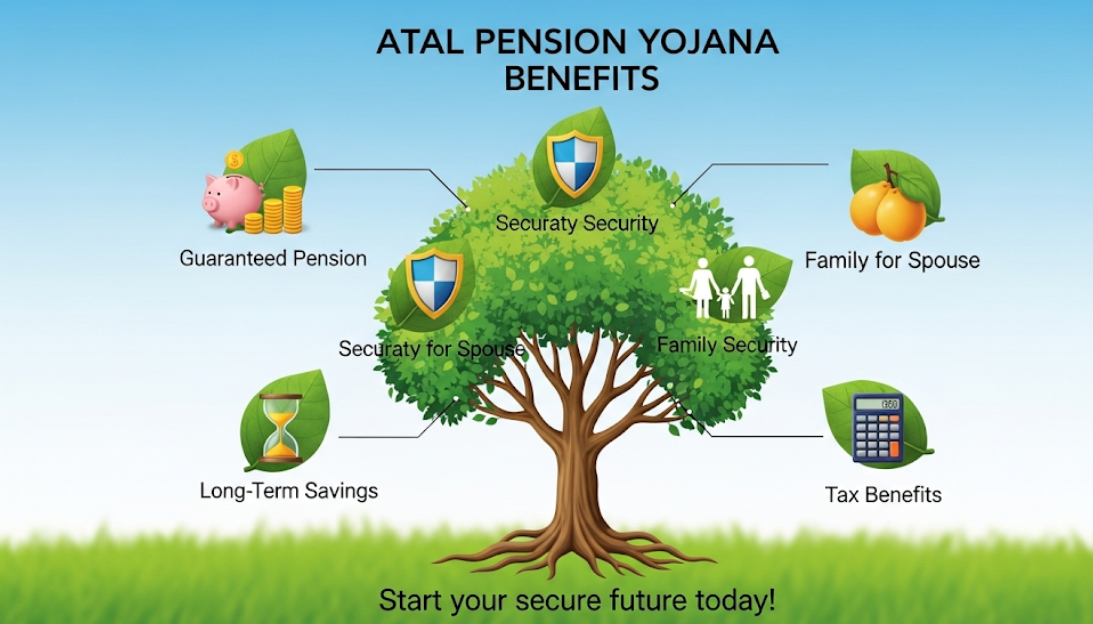

Breaking Down the Atal Pension Yojana Benefits

The atal pension yojana benefit package is comprehensive and designed to provide complete financial security during retirement. Let’s explore each benefit in detail:

Guaranteed Monthly Pension

The scheme offers five pension options:

- ₹1,000 per month

- ₹2,000 per month

- ₹3,000 per month

- ₹4,000 per month

- ₹5,000 per month

This pension starts from age 60 and continues for life. Even if you live to be 100, you’ll keep receiving your chosen pension amount every month.

Family Protection Features

For Spouse: If you pass away after turning 60, your spouse receives the same pension amount for their entire life. This ensures your family’s financial security doesn’t end with you.

Death Benefit Before 60: If something unfortunate happens before you turn 60, your spouse can either:

- Continue the scheme by paying the remaining contributions

- Receive the accumulated pension wealth as a lump sum

Nominee Protection: If both you and your spouse pass away, your nominee receives the entire accumulated pension corpus. This means your contributions don’t go waste and benefit your loved ones.

Government Co-Contribution Benefit

For the first five years, if you’re eligible, the government adds 50% of your contribution or ₹1,000 per year, whichever is lower. This is essentially free money added to your pension fund.

For example, if you contribute ₹2,000 annually, the government adds ₹1,000, making your total contribution ₹3,000. This significantly boosts your pension corpus without any extra effort from your side.

How Much Should You Contribute?

The atal pension yojana contribution chart varies based on your age when joining and the pension amount you choose. Here’s a detailed breakdown:

Monthly Contribution Chart

| Age When Joining | For ₹1,000 Pension | For ₹2,000 Pension | For ₹3,000 Pension | For ₹4,000 Pension | For ₹5,000 Pension |

|---|---|---|---|---|---|

| 18 years | ₹42 | ₹84 | ₹126 | ₹168 | ₹210 |

| 20 years | ₹50 | ₹100 | ₹150 | ₹198 | ₹248 |

| 25 years | ₹76 | ₹151 | ₹226 | ₹301 | ₹376 |

| 30 years | ₹116 | ₹231 | ₹347 | ₹462 | ₹577 |

| 35 years | ₹181 | ₹362 | ₹543 | ₹722 | ₹902 |

| 40 years | ₹291 | ₹582 | ₹873 | ₹1,164 | ₹1,454 |

Key Observations:

- Earlier is Better: Starting at 18 years requires only ₹42 monthly for ₹1,000 pension

- Cost Increases with Age: Joining at 40 requires ₹291 monthly for the same ₹1,000 pension

- Linear Scaling: Higher pension amounts require proportionally higher contributions

Payment Methods

Contributions are automatically deducted from your bank account on a:

- Monthly basis

- Quarterly basis

- Half-yearly basis

- Annual basis

You can choose the frequency that suits your cash flow best.

Step-by-Step Registration Process

Getting started with APY is surprisingly simple. Here’s how you can join:

Online Registration

- Visit your bank’s website or use their mobile app

- Navigate to the pension section and look for Atal Pension Yojana

- Fill the application form with accurate details

- Choose your pension amount (₹1,000 to ₹5,000)

- Set up auto-debit for monthly contributions

- Submit required documents digitally

Offline Registration

- Visit your bank branch with necessary documents

- Ask for APY application form

- Fill the form with bank officer’s assistance

- Submit documents for verification

- Sign the auto-debit mandate

- Receive acknowledgment with PRAN number

Documents Required

- Aadhaar card

- Bank account details

- Mobile number

- Nomination details

- Income proof (if applicable)

Processing Time

- Online applications: 2-3 working days

- Offline applications: 5-7 working days

You’ll receive a unique PRAN (Permanent Retirement Account Number) that you can use to track your account.

Managing Your APY Account

Getting Your Atal Pension Yojana Statement

Your atal pension yojana statement is crucial for tracking your investment progress. Here’s how to access it:

Online Methods:

- Bank’s website or app: Most banks provide APY statements in their digital platforms

- NSDL website: Visit enps.nsdl.com for detailed statements

- SMS service: Send SMS to get quick balance updates

Offline Methods:

- Bank branch visits: Get printed statements from your branch

- ATM receipts: Some banks provide mini statements at ATMs

What Your Statement Shows:

- Total contributions made

- Government co-contributions received

- Current account balance

- Projected pension amount

- Payment due dates

- Transaction history

Making Changes to Your Account

Increasing Pension Amount: You can increase your chosen pension amount once a year during April. However, you cannot decrease it.

Changing Bank Account: If you switch banks, you can transfer your APY account to the new bank without any penalty.

Updating Personal Information: Changes in address, mobile number, or nomination can be updated by visiting your bank branch.

What Happens If You Miss Payments?

Life is unpredictable, and sometimes you might miss a contribution. Here’s what you need to know:

Penalty Structure

- ₹1 per month for accounts with contributions up to ₹100

- ₹2 per month for accounts with contributions between ₹101-500

- ₹5 per month for accounts with contributions between ₹501-1,000

- ₹10 per month for accounts with contributions above ₹1,000

Account Freezing

If you don’t pay for 6 consecutive months, your account gets frozen. You won’t earn any returns during this period.

Account Closure

After 24 months of non-payment, the government can close your account and return your contributions with minimal interest.

How to Restart

You can reactivate a frozen account by paying all pending contributions plus penalties. It’s always better to restart rather than lose your investment.

Smart Strategies to Maximize Benefits

Start Early Strategy

The biggest advantage goes to early starters. A person joining at 18 pays significantly less than someone joining at 35 for the same pension benefit. According to financial experts at APBCCMS, starting early is the most effective retirement planning strategy.

Choose Higher Pension Amounts

If you can afford it, opt for higher pension amounts. The difference in contribution is marginal compared to the long-term benefits.

Utilize Government Co-Contribution

Ensure you’re eligible for government co-contribution in the first five years. This 50% additional contribution significantly boosts your corpus.

Regular Monitoring

Check your atal pension yojana statement regularly to ensure contributions are being deducted properly and your account is growing as expected.

Family Planning Integration

Consider APY as part of comprehensive family financial planning. Both spouses can have separate APY accounts for double benefits.

Comparing APY with Other Investment Options

APY vs. Fixed Deposits

| Feature | Atal Pension Yojana | Fixed Deposits |

|---|---|---|

| Returns | Guaranteed pension | Fixed interest |

| Tax Benefits | EEE status | Taxable returns |

| Lock-in Period | Until age 60 | Flexible |

| Government Backing | Full guarantee | Deposit insurance |

| Inflation Protection | Limited | None |

APY vs. Mutual Funds

| Feature | Atal Pension Yojana | Mutual Funds |

|---|---|---|

| Risk Level | Zero risk | Market risk |

| Returns | Fixed pension | Variable returns |

| Management | Automatic | Requires monitoring |

| Exit Options | Limited | High flexibility |

| Minimum Investment | ₹42 per month | Varies |

APY vs. PPF

| Feature | Atal Pension Yojana | Public Provident Fund |

|---|---|---|

| Investment Period | Until age 60 | 15 years |

| Tax Benefits | EEE status | EEE status |

| Pension Feature | Monthly pension | Lump sum only |

| Family Benefits | Spouse pension | Nomination only |

| Flexibility | Limited | Partial withdrawal |

Tax Benefits and Implications

The Atal Pension Yojana follows the EEE (Exempt-Exempt-Exempt) tax structure:

During Contribution Phase

- Contributions are eligible for tax deduction under Section 80CCD(1B)

- Additional deduction of up to ₹50,000 over and above Section 80C limit

- This reduces your taxable income significantly

During Accumulation Phase

- No tax on the growth of your pension corpus

- Government co-contributions are also tax-free

- No wealth tax or any other hidden taxes

During Pension Phase

- Monthly pension received is tax-free

- No TDS (Tax Deducted at Source) on pension payments

- Lump sum received by nominees is also tax-free

This makes APY extremely tax-efficient compared to other retirement options where pension is often taxable.

Real-Life Success Stories

Case Study 1: Ramesh, Age 25

Ramesh joined APY at 25, choosing the ₹3,000 pension option. His monthly contribution is ₹226. After 35 years of contributions, he’ll receive:

- ₹3,000 monthly pension for life

- Total contribution: ₹94,920

- Government co-contribution: ₹5,000

- Lifetime pension value (assuming 20 years): ₹7,20,000

Return on Investment: Over 700% returns!

Case Study 2: Priya, Age 30

Priya started at 30 with ₹2,000 pension option. Monthly contribution: ₹231. Benefits:

- ₹2,000 monthly pension from age 60

- If she lives till 80, total pension received: ₹4,80,000

- Total contributed: ₹83,160

- Net gain: ₹3,96,840

These examples show how the scheme of atal pension yojana creates substantial wealth over time.

Common Myths and Facts

Myth 1: “APY is only for poor people”

Fact: While targeted at the unorganized sector, anyone meeting eligibility criteria can join, regardless of income level.

Myth 2: “You lose money if you die early”

Fact: Your spouse continues receiving pension, and nominees get the accumulated amount. No money is lost.

Myth 3: “Government can change pension amounts”

Fact: Once enrolled, your pension amount is guaranteed and cannot be reduced by the government.

Myth 4: “APY returns are very low”

Fact: APY provides guaranteed returns equivalent to 8-10% annually, which is quite competitive for risk-free investments.

Myth 5: “You can’t exit the scheme”

Fact: While not recommended, you can exit after 5 years, though with penalties and loss of benefits.

Potential Drawbacks to Consider

While APY offers numerous benefits, it’s important to understand its limitations:

Inflation Impact

The fixed pension amount may lose purchasing power over time due to inflation. ₹1,000 today will have different value after 20-30 years.

Limited Liquidity

Your money is locked until age 60. Early exits result in penalties and loss of benefits.

No Partial Withdrawals

Unlike PPF, you cannot take loans or partial withdrawals for emergencies.

Fixed Returns

While guaranteed, the returns may be lower than potentially high-performing market investments.

Expert Tips for Success

Financial Planning Integration

Don’t rely solely on APY for retirement. Consider it as one component of a diversified retirement portfolio that might include:

- Employer provident fund

- National Pension System (NPS)

- Mutual funds

- Real estate investments

Regular Reviews

Annual review your atal pension yojana statement and assess whether your chosen pension amount is adequate for future needs.

Inflation Hedging

Consider increasing your pension amount annually when allowed to counter inflation effects.

Family Coordination

Discuss APY benefits with family members to ensure they understand the scheme’s features and benefits.

Future Outlook and Recent Updates

The Government of India continues to promote APY through various initiatives:

Digital Push

- Online enrollment processes have been simplified

- Mobile apps make account management easier

- Digital statements are now readily available

Coverage Expansion

- Government targets covering 10 crore people by 2027

- Special drives for women and rural populations

- Integration with other government schemes

Technology Integration

- Aadhaar-based authentication reduces paperwork

- Real-time contribution tracking

- Automated reminder systems for missed payments

Recent studies by pension experts suggest that APY enrollment has been growing at 15-20% annually, indicating increasing awareness about retirement planning among Indians.

Making the Right Decision

The atal pension yojana benefit package offers a unique combination of guaranteed returns, government backing, and family protection. However, the decision to join should align with your overall financial goals and risk appetite.

APY is Ideal If You:

- Prefer guaranteed returns over market risks

- Work in the unorganized sector without formal pension benefits

- Want simple, hassle-free retirement planning

- Value government guarantee and security

- Need family protection features

Consider Alternatives If You:

- Can handle market risks for potentially higher returns

- Need liquidity and flexibility in investments

- Have access to better employer-sponsored pension schemes

- Prefer DIY investment approach

Conclusion: Securing Your Golden Years

The Atal Pension Yojana represents a significant step toward creating a financially secure retirement for millions of Indians. With its guaranteed pension benefits, government backing, and family protection features, APY offers peace of mind in an uncertain world.

The atal pension yojana benefit extends beyond just monthly pension payments. It’s about dignity in old age, financial independence, and the comfort of knowing that your basic needs will be met regardless of economic conditions.

Starting early maximizes benefits, but it’s never too late to begin your retirement planning journey. Whether you’re 18 or approaching 40, APY can be a valuable addition to your financial portfolio.

Remember, retirement planning is not just about accumulating money; it’s about ensuring a comfortable lifestyle when you’re no longer earning. The Atal Pension Yojana makes this possible with minimal effort and maximum security.

Take the first step today. Visit your nearest bank branch or apply online to start building your pension corpus. Your future self will thank you for the decision you make today. After all, the best time to plant a tree was 20 years ago; the second-best time is now.

The journey to a secure retirement begins with a single step. Make APY your companion on this important journey, and look forward to golden years filled with financial confidence and peace of mind.