Everything About the Pradhan Mantri Suraksha Bima Yojana

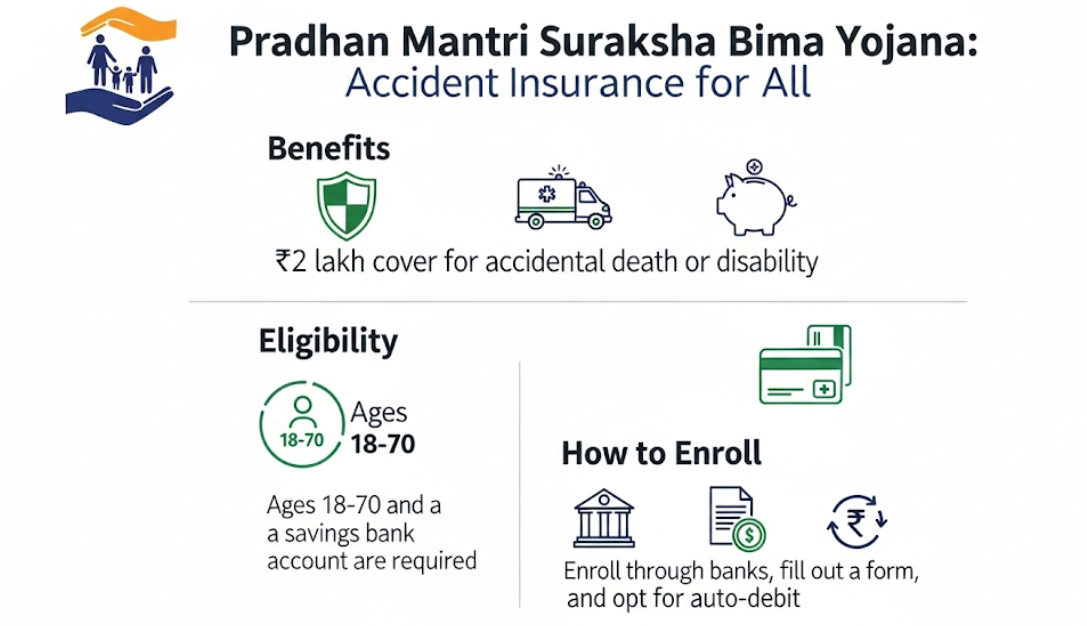

Life can be unpredictable, and accidents happen when we least expect them. What if there was a way to protect yourself and your family from financial hardship after an accident, all for just ₹12 per year? The Pradhan Mantri Suraksha Bima Yojana (PMSBY) makes this possible, offering one of the most affordable accident insurance schemes in India.

Launched by the Government of India in 2015, this revolutionary insurance scheme has already enrolled millions of Indians, providing them with financial security against accidental death and disability. Whether you’re a farmer, shopkeeper, daily wage worker, or salaried employee, PMSBY offers equal protection to all, making insurance truly accessible for every Indian.

What Exactly is Pradhan Mantri Suraksha Bima Yojana?

The pradhan mantri suraksha bima yojana is a government-backed accident insurance scheme that provides coverage against accidental death and permanent disability. Think of it as a safety net that catches you when life throws unexpected challenges your way.

This scheme operates on a simple principle: maximum coverage at minimum cost. For just ₹12 annually, you get insurance coverage worth ₹2 lakh. This makes it one of the most cost-effective insurance products available in the Indian market today.

Key Features That Make PMSBY Special

- Ultra-low premium: Only ₹12 per year

- High coverage: Up to ₹2 lakh protection

- Auto-renewal: Your policy renews automatically

- Wide acceptance: Available through all major banks

- Simple process: Minimal documentation required

- Age-friendly: Covers people aged 18 to 70 years

Complete PMSBY Eligibility Criteria

Before you rush to apply, let’s check if you qualify for this scheme. The government has kept the eligibility requirements simple and inclusive.

Primary Eligibility Requirements

- Age Limit: You must be between 18 to 70 years old

- Bank Account: Must have a savings bank account

- Citizenship: Indian citizen only

- Account Status: Your bank account should be active

- KYC Compliance: Your account must be KYC compliant

Important Points to Remember

- You can enroll through any bank where you have a savings account

- If you have accounts in multiple banks, you can choose any one for enrollment

- Non-resident Indians (NRIs) are not eligible for this scheme

- The scheme is available for both individual and joint account holders

PMSBY Benefits: What Protection Do You Get?

The pmsby benefits are straightforward yet comprehensive. Let’s break down exactly what coverage you receive:

Coverage Details

| Type of Incident | Compensation Amount |

|---|---|

| Accidental Death | ₹2,00,000 |

| Permanent Total Disability | ₹2,00,000 |

| Permanent Partial Disability | ₹1,00,000 |

What Counts as Permanent Total Disability?

Permanent total disability includes:

- Loss of both hands or both feet

- Loss of sight in both eyes

- Loss of one hand and one foot

- Loss of sight in one eye and loss of one hand or foot

What is Permanent Partial Disability?

This covers:

- Loss of one hand or one foot

- Loss of sight in one eye

- Loss of hearing in both ears

Additional Benefits You Should Know

- Family Protection: In case of accidental death, your nominee receives the full amount

- Disability Support: Provides financial help when you need it most

- No Medical Examination: No health check-up required for enrollment

- Cashless Claims: Direct payment to nominees or beneficiaries

PMSBY Premium Amount: Affordable Protection for All

The pmsby premium amount is what makes this scheme truly remarkable. At just ₹12 per year, it’s equivalent to ₹1 per month – less than what you spend on a cup of tea!

Premium Breakdown

- Annual Premium: ₹12

- Service Tax: Included in the premium

- Processing Fee: No additional charges

- Renewal Fee: Same ₹12 every year

How Premium Payment Works

The premium is automatically deducted from your linked savings bank account every year on June 1st or the date of joining if you enroll later. This auto-debit system ensures you never miss a payment and your coverage remains active.

Payment Methods Available

- Auto-debit from savings account (recommended)

- Cash payment at bank branches

- Online banking

- Mobile banking apps

For more information about government schemes and financial planning, you can visit APBC CMS for additional resources.

Step-by-Step PMSBY Claim Process

When the unexpected happens, knowing the pmsby claim process can save you valuable time and ensure you receive your rightful compensation quickly.

Documents Required for Claims

For Death Claims:

- Claim form (filled by nominee)

- Death certificate

- Post-mortem report (if applicable)

- Police FIR copy (for accidental deaths)

- Hospital records

- Cancelled cheque of nominee’s account

For Disability Claims:

- Claim form (filled by policyholder)

- Disability certificate from authorized medical practitioner

- Hospital treatment records

- Police complaint copy (if applicable)

- Identity proof

- Bank account details

Detailed Claim Filing Process

Step 1: Immediate Action

- Inform your bank about the incident within 30 days

- Collect all necessary documents

- Fill the claim form completely

Step 2: Document Submission

- Submit all required documents to your bank branch

- Keep photocopies of all submitted documents

- Get acknowledgment receipt from the bank

Step 3: Verification Process

- Bank verifies all submitted documents

- Insurance company conducts investigation if needed

- Additional documents may be requested

Step 4: Claim Settlement

- Approved claims are settled within 30-45 days

- Money is directly transferred to the nominee’s account

- SMS confirmation sent to registered mobile number

Claim Settlement Timeline

| Claim Type | Typical Processing Time |

|---|---|

| Death Claims | 30-45 days |

| Total Disability | 45-60 days |

| Partial Disability | 30-45 days |

How to Apply for PMSBY: Multiple Easy Ways

Getting enrolled in the pradhan mantri suraksha bima yojana is simpler than you think. Here are all the ways you can apply:

Method 1: Online Application

- Log in to your bank’s internet banking

- Navigate to insurance section

- Select PMSBY option

- Fill the application form

- Submit and confirm enrollment

Method 2: Bank Branch Visit

- Visit your nearest bank branch

- Request PMSBY enrollment form

- Fill all details accurately

- Submit with required documents

- Get enrollment confirmation

Method 3: Mobile Banking

- Open your bank’s mobile app

- Go to insurance/investment section

- Choose PMSBY

- Complete online enrollment

- Receive confirmation SMS

Method 4: Common Service Centers

Many rural areas have Common Service Centers where you can enroll with help from trained operators.

What’s Not Covered: Important Exclusions

Like any insurance policy, PMSBY has certain exclusions. Knowing these helps you understand exactly what protection you have:

Major Exclusions

- Suicide or self-inflicted injuries

- Death or disability due to war

- Nuclear risks and radiation

- Criminal activities participation

- Adventure sports injuries (unless specifically covered)

- Death due to illness or natural causes

Pre-existing Conditions

Since PMSBY covers only accidents, pre-existing medical conditions that lead to death or disability are not covered.

Success Stories: Real People, Real Benefits

The pradhan mantri suraksha bima yojana has transformed lives across India. Here are some inspiring examples:

Case Study 1: Rural Farmer from Uttar Pradesh

A farmer from a small village in UP met with a tractor accident. Thanks to PMSBY, his family received ₹2 lakh compensation, which helped them during the difficult time and continue their farming activities.

Case Study 2: Urban Worker from Mumbai

A construction worker in Mumbai suffered permanent disability in a workplace accident. The ₹2 lakh coverage helped him start a small business and support his family despite his disability.

According to recent government data available on the Insurance Regulatory and Development Authority of India website, over 22 crore people have enrolled in PMSBY since its launch, making it one of the most successful insurance schemes in India.

Comparing PMSBY with Other Insurance Options

Understanding how PMSBY stacks up against other insurance products helps you make informed decisions:

PMSBY vs. Traditional Accident Insurance

| Feature | PMSBY | Traditional Insurance |

|---|---|---|

| Premium | ₹12/year | ₹1,000-5,000/year |

| Coverage | ₹2 lakh | ₹5-50 lakh |

| Medical Exam | Not required | Often required |

| Age Limit | 18-70 years | Varies |

| Enrollment | Through banks | Insurance companies |

Why Choose PMSBY?

- Extremely affordable for basic protection

- No medical examination hassles

- Government backing ensures reliability

- Wide availability through all banks

- Simple processes for enrollment and claims

Tips for Maximizing Your PMSBY Benefits

Smart Enrollment Strategies

- Enroll Early: Join as soon as you’re eligible to maximize coverage years

- Keep Records: Maintain all enrollment documents safely

- Update Nominee: Regularly update nominee details as family situations change

- Maintain Account: Keep your linked bank account active and funded

Important Maintenance Tasks

- Annual Premium: Ensure sufficient balance for auto-debit

- Contact Updates: Keep mobile number and address updated

- Document Safety: Store all insurance documents securely

- Regular Reviews: Check your coverage status annually

Avoiding Common Mistakes

- Don’t ignore renewal notices from your bank

- Never provide false information during enrollment

- Keep nominee details updated to avoid claim delays

- Maintain proper documentation of accidents for faster claims

For comprehensive guidance on financial planning and government schemes, the Ministry of Finance website offers detailed resources and updates.

Future of PMSBY: Recent Updates and Changes

The government continuously works to improve the pradhan mantri suraksha bima yojana based on user feedback and changing needs.

Recent Enhancements

- Digital Integration: Enhanced online enrollment processes

- Faster Claims: Reduced claim settlement times

- Better Awareness: Increased promotional activities

- Rural Reach: Expanded availability in remote areas

What’s Coming Next?

The government is exploring options to:

- Increase coverage amounts while maintaining affordability

- Add more types of accidents to coverage

- Integrate with other social security schemes

- Improve digital claim processes further

Making the Smart Choice: Why PMSBY Makes Sense

In today’s uncertain world, having some form of accident protection is not just wise – it’s essential. The pradhan mantri suraksha bima yojana offers an entry point into the world of insurance for millions of Indians who previously couldn’t afford protection.

For Different Life Stages

Young Adults (18-25 years)

- Perfect introduction to insurance

- Builds financial planning habits

- Affordable on any budget

Working Professionals (25-50 years)

- Complements existing insurance

- Additional family protection

- Minimal impact on finances

Senior Citizens (50-70 years)

- Continued protection in vulnerable years

- No medical exam requirements

- Same affordable premium

The Bottom Line

At just ₹12 per year, PMSBY costs less than a movie ticket but provides protection worth ₹2 lakh. Even if you have other insurance policies, PMSBY serves as valuable additional coverage. For many Indians, especially those in rural areas or with limited incomes, it might be their only formal insurance protection.

Conclusion: Your Safety Net is Just ₹12 Away

The Pradhan Mantri Suraksha Bima Yojana represents the government’s commitment to making insurance accessible to every Indian citizen. With its ultra-affordable premium, comprehensive coverage, and simple processes, PMSBY breaks down the traditional barriers that kept insurance out of reach for millions.

Whether you’re a student, farmer, worker, or retiree, accidents don’t discriminate, and neither should insurance protection. For the cost of a cup of tea each month, you can secure financial protection worth ₹2 lakh for yourself and peace of mind for your family.

The pmsby benefits extend beyond just financial coverage – they represent security, dignity, and hope during life’s most challenging moments. The pmsby claim process is designed to be straightforward, ensuring that when you need help most, bureaucracy doesn’t stand in your way.

Don’t wait for tomorrow to secure your today. Visit your bank branch, log into your internet banking, or call your bank’s customer service to enroll in PMSBY right now. Your future self – and your family – will thank you for this small but significant step toward financial security.

Remember, in the game of life, it’s not about avoiding risks entirely – it’s about being prepared when they find you. PMSBY ensures you’re always prepared, always protected, and always covered, all for just ₹12 a year.